Explained: The cost of rising imports

By Harish Damodaran

Rao Gulab Singh Lodi has harvested roughly 90 quintals of summer moong (green gram) from his 16-acres land in Nanhegaon village of Madhya Pradesh’s Narsinghpur district.

His major worry: The government’s apathy in procuring the pulses crop that’s fetching Rs 6,000 or so per quintal in the open market, as against its official minimum support price (MSP) of Rs 8,682.

It’s not only moong.

Lodhi cultivates soyabean during the kharif (monsoon) season, sowing the leguminous oilseed in early-July and harvesting by mid-October, followed by chana (chickpea) and masoor (red lentil) during rabi (winter-spring). After harvesting masoor towards March 10 and chana around March 15-20, he sows summer moong that matures in 60-70 days.

In none of these crops is there any systematic government procurement at MSP, comparable to that in rice and wheat. “It is my misfortune that I cannot grow rice or even wheat (except for self-consumption) here. The black cotton soil in my area is basically suitable for pulses and oilseeds,” says Lodhi.

The 65-year-old is a progressive farmer. He plants the best recommended varieties, whether in soyabean (‘JS 20-116’ and ‘JS 2172’ bred by the Jawaharlal Nehru Krishi Vishwa Vidyalaya at Jabalpur), moong (‘PDM 139’ by the Indian Institute of Pulses Research, Kanpur), masoor (‘IPL 329’ by the same institute) or chana (‘Pusa Manav’ by the Indian Agricultural Research Institute, New Delhi

But Lodhi isn’t as lucky as the farmers who take rice and wheat. Soyabean is selling in MP’s mandis at Rs 4,100-4,200 per quintal. That’s below not only the MSP of Rs 5,328 for the upcoming 2025-26, but even the Rs 4,892 of last year’s crop.

Record pulses imports

The woes for Indian pulses and oilseeds growers come amid all-time-high imports during 2024-25 (April-March).

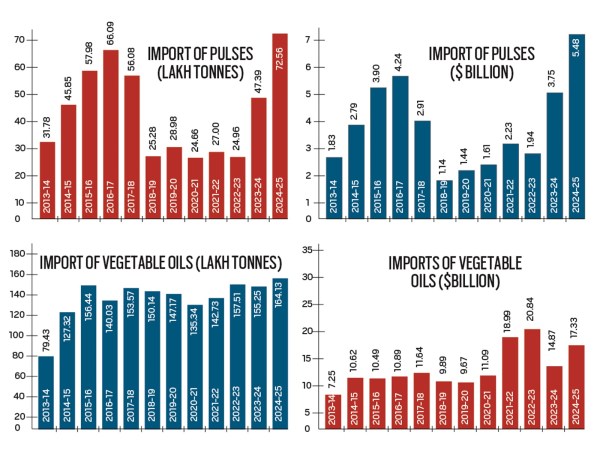

In the case of pulses, these touched 7.3 million tonnes (mt) and valued at $5.5 billion, surpassing the previous record of 6.6 mt and $4.2 billion for 2016-17.

Pulses imports had actually registered a substantial dip after 2017-18, to an average of 2.6 mt worth $1.7 billion during the subsequent five years (Charts 1a and 1b). This came on the back of improved domestic production. India’s pulses output, which stood at 19.3 mt in 2013-14 and 17.2 mt in 2014-15 and 16.3 mt in 2015-16 (both drought years), climbed to 27.3 mt in 2021-22 and 26.1 mt in 2022-23.

Much of that was courtesy of chana and moong, with scientists breeding short-duration varieties (100-120 days) requiring hardly any irrigation in the former and those amenable to growing across all seasons in the latter. Farmers today plant moong in kharif and rabi as well as spring and summer.

However, the relative self-sufficiency or atmanirbharta achieved in pulses was reversed in 2023-24, which was an El Niño-induced drought year. Domestic production dropped to 24.2 mt in 2023-24 and recovered partly to 25.2 mt in 2024-25, as per the Agriculture Ministry’s data. Falling output and retail inflation in pulses soaring to double digits by mid-2023 led to a slashing of duties on imports, which peaked during the last fiscal.

The 7.3 mt of pulses imports in 2024-25 included 2.2 mt of yellow/white peas (largely from Canada and Russia), 1.6 mt of chana (from Australia), 1.2 mt each of arhar or pigeon-pea (from Mozambique, Tanzania, Myanmar, Sudan and Malawi) and masoor (from Canada, Australia and United States), and 0.8 mt of urad or black gram (from Myanmar and Brazil).

As imports surged, the consumer price index (CPI) inflation in pulses eased to 3.8% year-on-year by December 2024 and further to 2.6%, -0.4%, -2.7%, -5.2% and -8.2% in the following five months. The shoe is on the other foot now, with arhar and chana selling at Rs 6,400-6,450 and Rs 5,450-5,500 per quintal respectively in Maharashtra’s Latur mandi, below their corresponding MSPs of Rs 7,550 and Rs 5,650.

The other oil

In vegetable oils, the story has been a more uniform one – of increasing import dependence.

The last 11 years have seen imports more than double from 7.9 mt to 16.4 mt, a trend that the Narendra Modi government may want to arrest, if not reverse.

In value terms, imports almost trebled from $7.2 billion in 2013-14 to $20.8 billion in 2022-23, which was around the time when international prices skyrocketed owing to supply disruptions from the Russia-Ukraine war. While global prices have come off those peaks, the quantum of imports has continued to rise (Charts 2a and 2b).

The 16.4 mt of imports during 2024-25 mainly comprised 7.9 mt of palm (primarily from Indonesia and Malaysia), 4.8 mt of soyabean (from Argentina and Brazil) and 3.5 mt of sunflower oil (from Russia, Ukraine and Argentina). On the other hand, India’s production of oil from domestically grown oilseeds and secondary sources such as cottonseed, rice bran and maize is estimated at just about 10 mt, translating into an import dependence of well over 60%.

CPI inflation in vegetable oils, unlike pulses, has been ruling at double digits since November 2024, with the latest May reading at 17.9%. It explains the Modi government’s decision, on May 30, to cut the basic customs duty on crude palm, soyabean and sunflower oil from 20% to 10% and the overall import tariff (after adding an agriculture cess and social welfare surcharge) from 27.5% to 16.5%.

The US Department of Agriculture (USDA) expects the lowering of duty to result in a “further increase” in soyabean oil imports by India. Although its market is dominated by Argentina, “the reduced tariff can boost the import of US soyabean oil,” a USDA report, dated June 10, has stated.

All this would mean imports likely hitting a new high in the current fiscal, even as the USDA has projected a record-breaking global vegetable oil output of 235 mt for 2025-26, led by palm (80.7 mt) and soyabean (70.8 mt). And that may not be good news for farmers like Lodhi.

The Soyabean Processors Association of India has expressed concern over the 11-percentage points duty cut, which is expected to “flood the Indian market with cheaper imported oils”. That will make oilseed cultivation less attractive to farmers, who may sow less area and switch to other more profitable crops in this kharif season, said Davish Jain, chairman of the Indore-based association.

This article has been republished from The Indian Express.